House Bill 2958 would double the state’s match of the federal Earned Income Tax Credit and extend it to workers

Report

Report

Latest Articles

Despite the prevalence of wage theft, the state agency tasked with protecting workers has fewer resources to combat the problem

There is growing interest in the power of Workforce Standards Boards to improve pay and working conditions in industries with

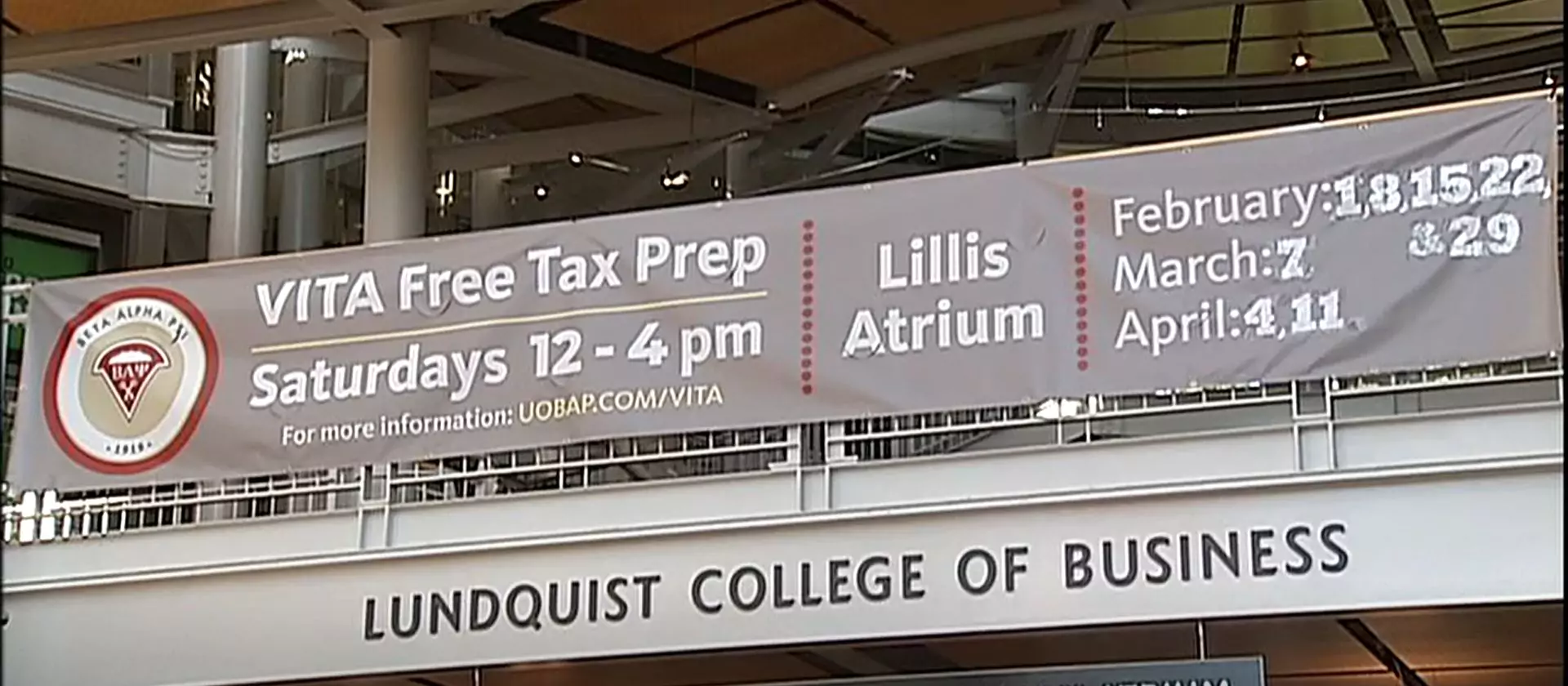

The main barrier households face in claiming the EITC is the complexity involved in filing taxes

One way to improve the kicker for rural communities would be to transform the policy into the Working Families Kicker

While Oregon is witnessing a resurgence of labor activity and a growing demand for union representation, worker organizing still faces

It is not only possible to imagine a better tax filing system in Oregon, but also to realize it. Getting

Complete Reporting is a smart, effective way Oregon can make corporations pay their fair share to support schools and essential

There are ways to reform the kicker that would produce more equitable results — reforms that would be good for

By the end of this decade, local governments in Oregon could have about $140 million less per year to pay

Latest Podcasts

Senator Wyden on the Trump tax plan: “It’s going to cause a lot of hardship”

The Trump tax plan would cut Medicaid and nutrition assistance to pay for big tax cuts for the rich.

April 10, 2025

How to improve pay and working conditions in entire industries in one fell swoop

The revival of an old idea is offering hope for improving pay and working conditions in entire industries all at

March 13, 2025

Two things that are making tax filing easy and free for Oregonians

In this episode of Policy for the People, we discuss two initiatives that are making tax filing easy and free.

February 13, 2025