About a quarter-million Oregon working families face a tax increase if Senators in the minority fail to return to Salem

News Release

News Release

Latest Articles

As Oregon lawmakers consider increasing the state’s Earned Income Tax Credit (EITC), a new national report examines how state EITCs

Oregon’s ultra-rich — the highest-earning one out of every 1,000 Oregonians — have never been so rich compared to the

The majority of Oregon families living in poverty have at least one working parent, and often that parent works full

Large multinational corporations would have a harder time shielding their profits from Oregon taxes if the state reinstated a law

Oregon’s poorest families pay more in taxes as a share of income than any group of taxpayers in the state,

Even though the paychecks of Oregon workers have grown recently, many workers have seen no real gains in their wages

The Oregon Center for Public Policy, the state’s leading public policy think tank, has selected Alejandro Queral as its new

Oregon is a case study of what can go wrong when states artificially limit property taxes. Examining the experiences of

Oregon is now largely defenseless against the well-worn practice of corporations escaping taxes by artificially shifting profits to foreign tax

Latest Podcasts

Senator Wyden on the Trump tax plan: “It’s going to cause a lot of hardship”

The Trump tax plan would cut Medicaid and nutrition assistance to pay for big tax cuts for the rich.

April 10, 2025

How to improve pay and working conditions in entire industries in one fell swoop

The revival of an old idea is offering hope for improving pay and working conditions in entire industries all at

March 13, 2025

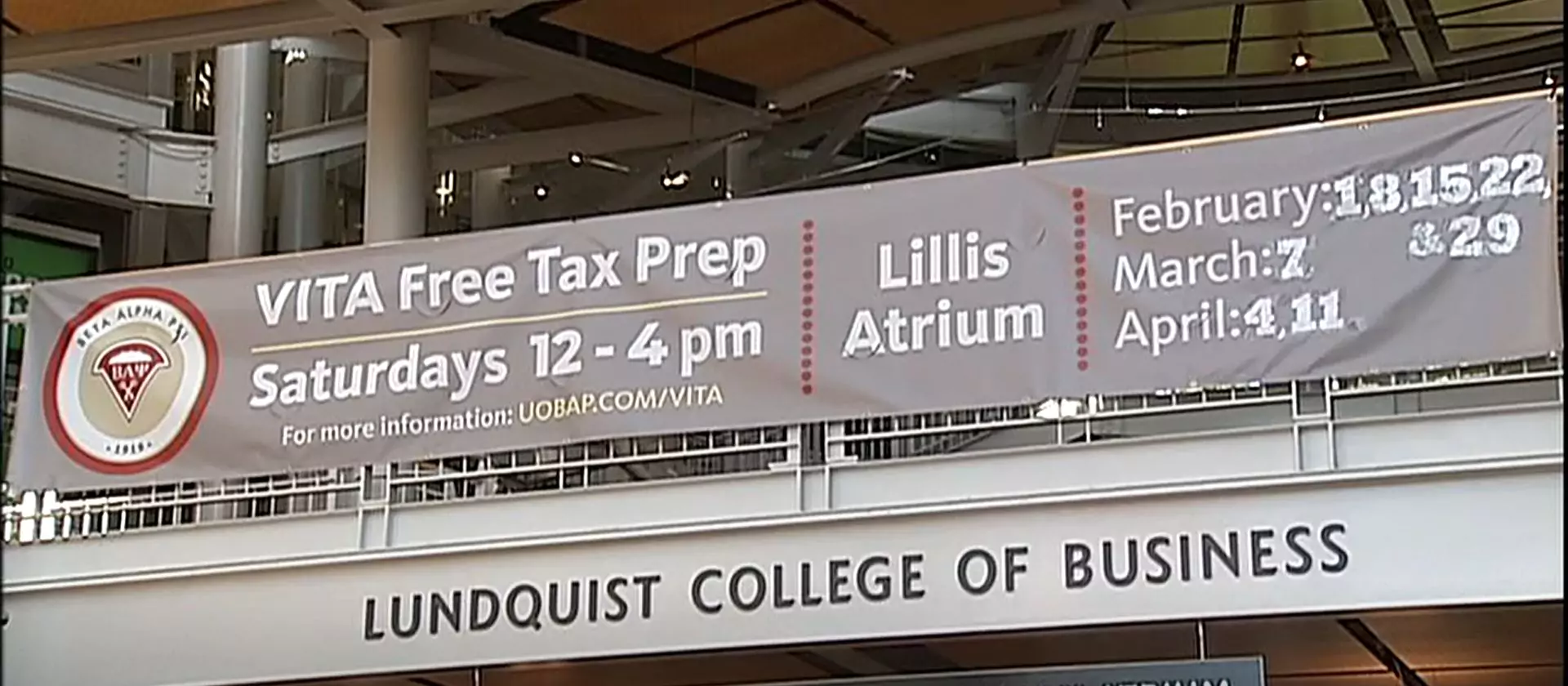

Two things that are making tax filing easy and free for Oregonians

In this episode of Policy for the People, we discuss two initiatives that are making tax filing easy and free.

February 13, 2025