Large multinational corporations would have a harder time shielding their profits from Oregon taxes if the state reinstated a law

Tax Loopholes

Tax Loopholes

Latest Articles

Oregon is now largely defenseless against the well-worn practice of corporations escaping taxes by artificially shifting profits to foreign tax

OCPP communications director Juan Carlos Ordóñez and policy analyst Daniel Hauser lead a webinar on the need to close Oregon's

My name is Daniel Hauser, tax policy analyst for the Oregon Center for Public Policy, and I respectfully submit this

At a time when Oregon schools are underfunded and when many Oregon families struggle to make ends meet, the last

By eliminating a law known as the “throwback rule,” a bill currently in the Oregon legislature would create a new

The federal tax plan that Congress recently passed is stuffed with tax cuts for the wealthy, and one of the

As the legislative session winds down, the Oregon Senate has an opportunity to correct a serious tax injustice from a

This week, the Kansas legislature finally had enough. On a bipartisan vote, it pulled the plug on a massive tax

In a world in which the State of Oregon has unlimited revenue to spend addressing society's needs for education, economic

Latest Podcasts

Senator Wyden on the Trump tax plan: “It’s going to cause a lot of hardship”

The Trump tax plan would cut Medicaid and nutrition assistance to pay for big tax cuts for the rich.

April 10, 2025

How to improve pay and working conditions in entire industries in one fell swoop

The revival of an old idea is offering hope for improving pay and working conditions in entire industries all at

March 13, 2025

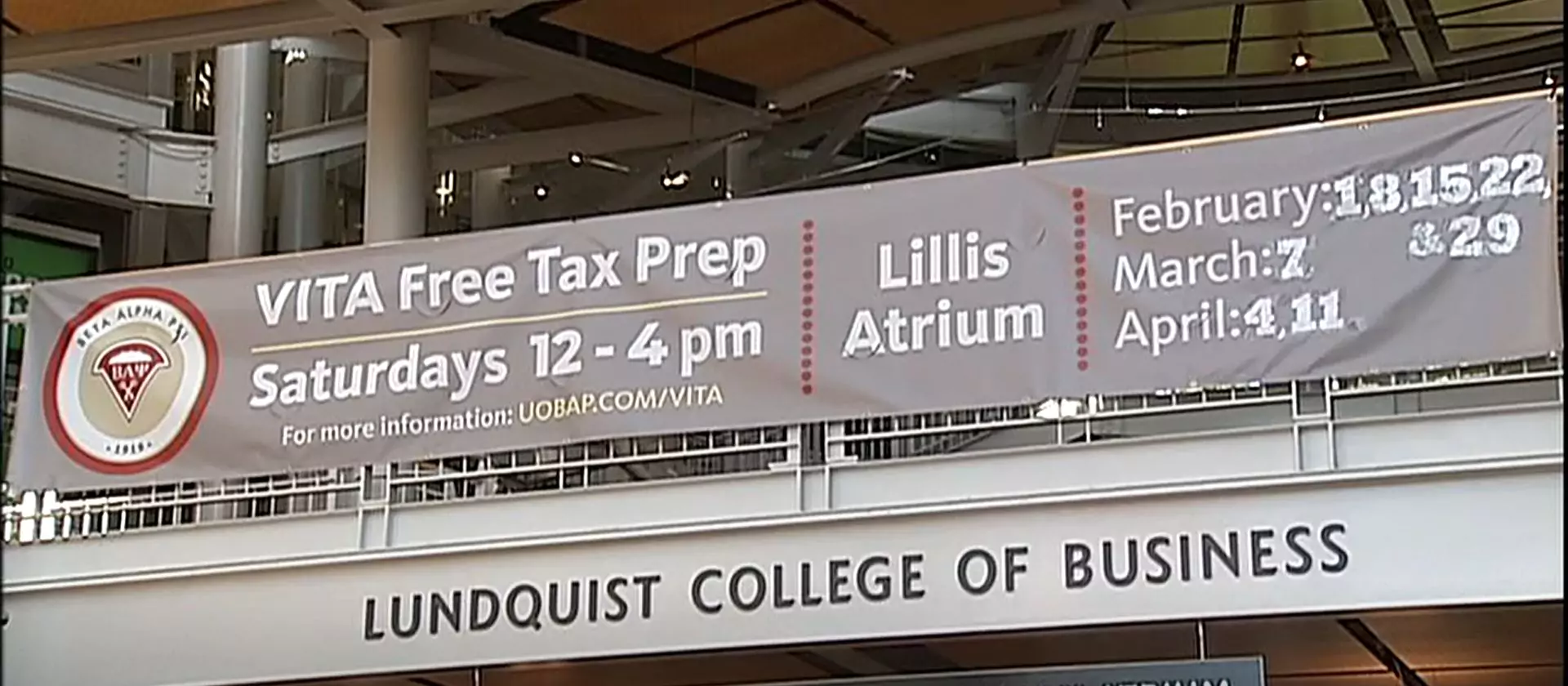

Two things that are making tax filing easy and free for Oregonians

In this episode of Policy for the People, we discuss two initiatives that are making tax filing easy and free.

February 13, 2025