By the end of this decade, local governments in Oregon could have about $140 million less per year to pay

Property Taxes

Property Taxes

Latest Articles

Chair Nathanson, Vice-Chair Reschke, Vice-Chair Marsh, and Members of the Committee, My name is Daniel Hauser, tax policy analyst for

Oregon is a case study of what can go wrong when states artificially limit property taxes. A new national report

Oregon is a case study of what can go wrong when states artificially limit property taxes. Examining the experiences of

Latest Podcasts

Senator Wyden on the Trump tax plan: “It’s going to cause a lot of hardship”

The Trump tax plan would cut Medicaid and nutrition assistance to pay for big tax cuts for the rich.

April 10, 2025

How to improve pay and working conditions in entire industries in one fell swoop

The revival of an old idea is offering hope for improving pay and working conditions in entire industries all at

March 13, 2025

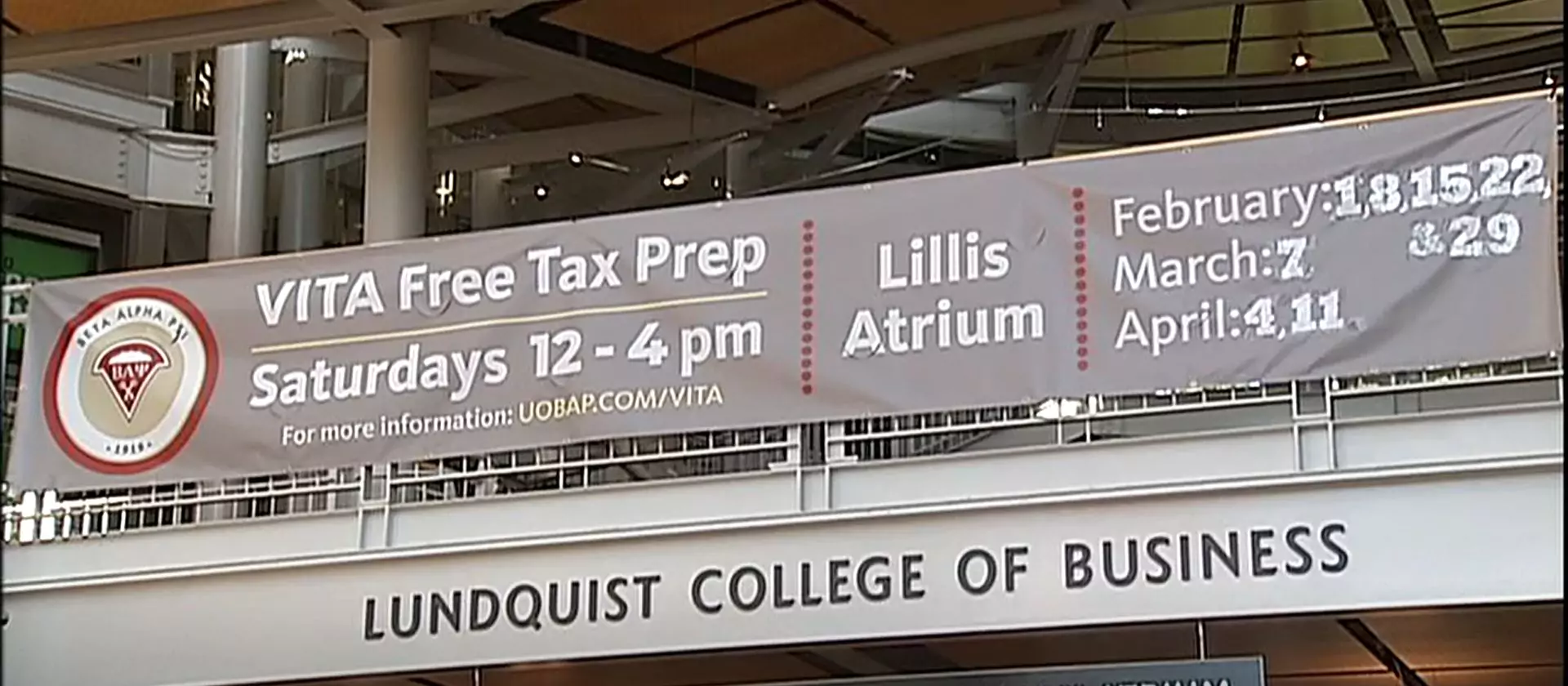

Two things that are making tax filing easy and free for Oregonians

In this episode of Policy for the People, we discuss two initiatives that are making tax filing easy and free.

February 13, 2025