Creating a personal income tax credit to address the impact of a proposed commercial activities tax (CAT), instead of reducing

Corporate & Business Taxes

Corporate & Business Taxes

Latest Articles

With the clock ticking on an Oregon legislative session that has yet to resolve a $1.4 billion revenue shortfall, the

The Oregon House leadership should be commended for putting forward a bold revenue proposal that would improve the lives of

As Oregon lawmakers consider raising corporate taxes to prevent cuts to schools and other public services, a new report finds

Dark political money is flowing in Oregon. It seeks to squelch efforts in the legislature to raise taxes on corporations.

This Groundhog Day, Oregon woke up to the same sad reality. Our schools remain woefully underfunded. Too many Oregonians still

Measure 97's defeat in the November election does not change the fact that corporations in Oregon are paying far too

Here at the Oregon Center for Public Policy, we’re wasting no time thinking about — and advocating for — a

November 8, 2016, will be remembered as a dark day in Oregon history. An avalanche of corporate-funded misinformation buried the

The Great Recession slammed Oregon public schools, causing teacher layoffs and exacerbating the overcrowding of classrooms. Six years after the

Latest Podcasts

Senator Wyden on the Trump tax plan: “It’s going to cause a lot of hardship”

The Trump tax plan would cut Medicaid and nutrition assistance to pay for big tax cuts for the rich.

April 10, 2025

How to improve pay and working conditions in entire industries in one fell swoop

The revival of an old idea is offering hope for improving pay and working conditions in entire industries all at

March 13, 2025

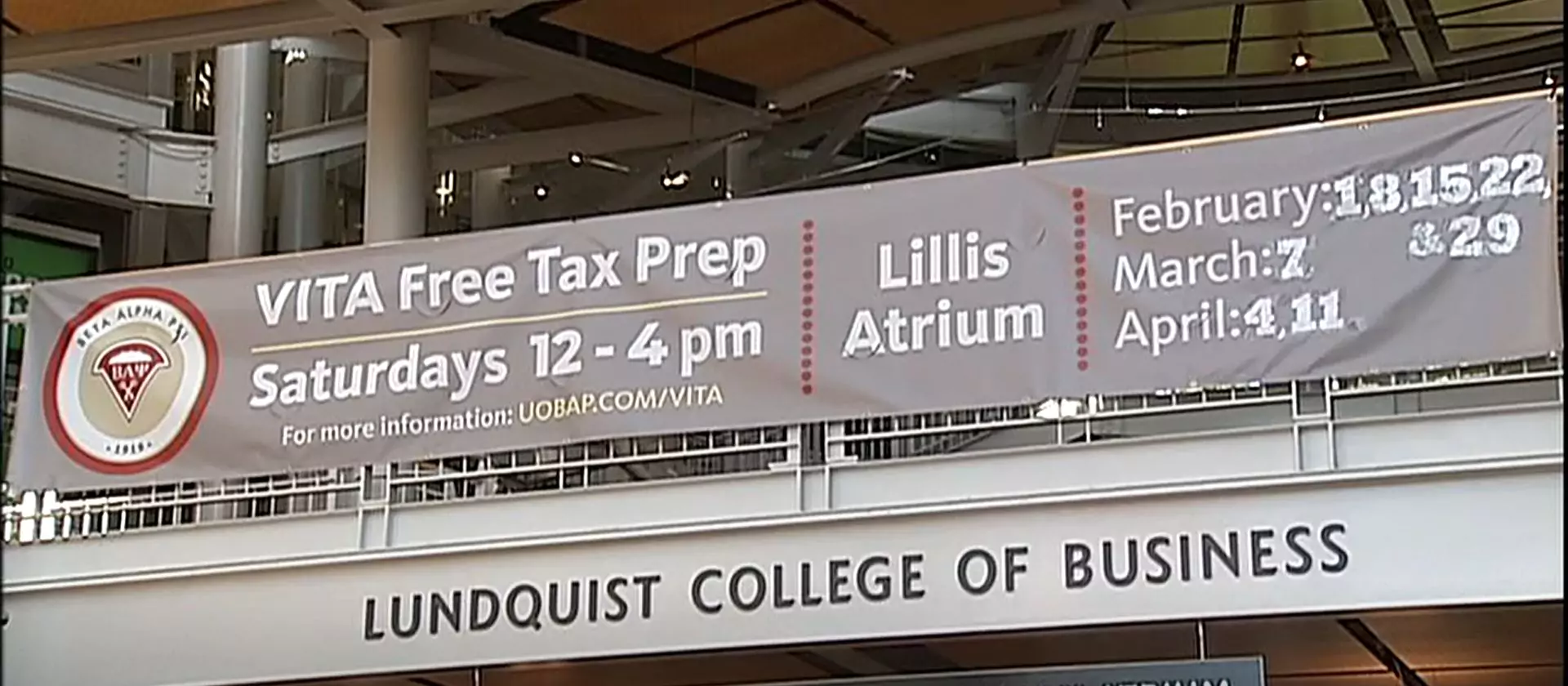

Two things that are making tax filing easy and free for Oregonians

In this episode of Policy for the People, we discuss two initiatives that are making tax filing easy and free.

February 13, 2025