Fans of the classic kids’ television show Schoolhouse Rock will remember How a Bill Becomes Law, the animated music video

Corporate & Business Taxes

Corporate & Business Taxes

Latest Articles

Corporations in Oregon are on track to pay a smaller share of Oregon income taxes this budget period than at

When it comes to tax avoidance, Nike lives by its slogan “Just Do It.” The Oregonian recently reported that “Nike

Oregon’s corporate minimum tax needs a significant boost for it to meet its intended purpose — ensuring that all corporations

The League of Women Voters of Portland hosted a debate on Measure 103. OCPP communications director Juan Carlos Ordóñez argued

Chair Barnhart, Vice-Chairs Smith and Smith Warner, members of the Committee: My name is Daniel Hauser, tax policy analyst for

It’s never too late to hope that lawmakers do the right thing. Here at the Oregon Center for Public Policy,

Twenty-five cents for every $100 in sales. That is how much a company in the construction industry with $100 million

I’ve heard some folks opposed to enacting a Commercial Activities Tax (CAT) complain that taxing gross receipts, rather than profits,

Latest Podcasts

Senator Wyden on the Trump tax plan: “It’s going to cause a lot of hardship”

The Trump tax plan would cut Medicaid and nutrition assistance to pay for big tax cuts for the rich.

April 10, 2025

How to improve pay and working conditions in entire industries in one fell swoop

The revival of an old idea is offering hope for improving pay and working conditions in entire industries all at

March 13, 2025

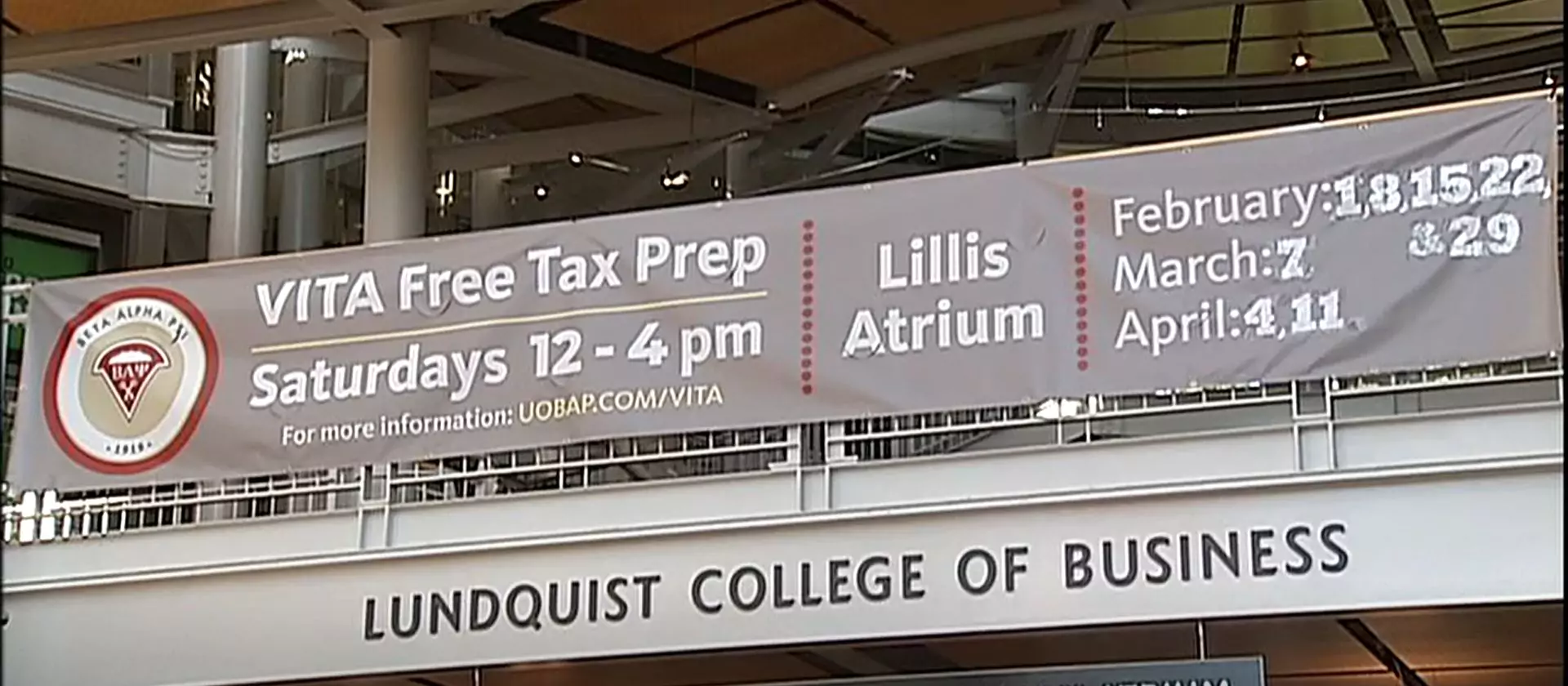

Two things that are making tax filing easy and free for Oregonians

In this episode of Policy for the People, we discuss two initiatives that are making tax filing easy and free.

February 13, 2025

Oregon must protect working families by rejecting calls for broad business tax cuts