Oregon families are among the least likely to benefit from the Earned Income Tax Credit (EITC) — a tax credit

Family Tax Credits

Family Tax Credits

Latest Articles

Only two states fared worse than Oregon in 2016 when it came to share of families that qualified for the

Without a doubt, our country can vastly improve the economic prospects of families scraping by on low wages.

State lawmakers have much to be proud of, having enacted Oregon’s largest investment in education in memory. This and future

Tax Day is one of the most important days on the calendar when it comes to the fight against poverty.

Tax Day is one of the most important days on the calendar when it comes to the fight against poverty.

As Oregon lawmakers consider increasing the state’s Earned Income Tax Credit (EITC), a new national report examines how state EITCs

Today, low-income working families achieved a significant victory with the Oregon Senate’s approval of Senate Bill 398-B in a bipartisan

The Oregon Center for Public Policy (OCPP) supports Senate Bill 398 and its effort to increase the use of the

Oregon ranks near the bottom when it comes to the share of qualifying families that claim the federal Earned Income

Latest Podcasts

Senator Wyden on the Trump tax plan: “It’s going to cause a lot of hardship”

The Trump tax plan would cut Medicaid and nutrition assistance to pay for big tax cuts for the rich.

April 10, 2025

How to improve pay and working conditions in entire industries in one fell swoop

The revival of an old idea is offering hope for improving pay and working conditions in entire industries all at

March 13, 2025

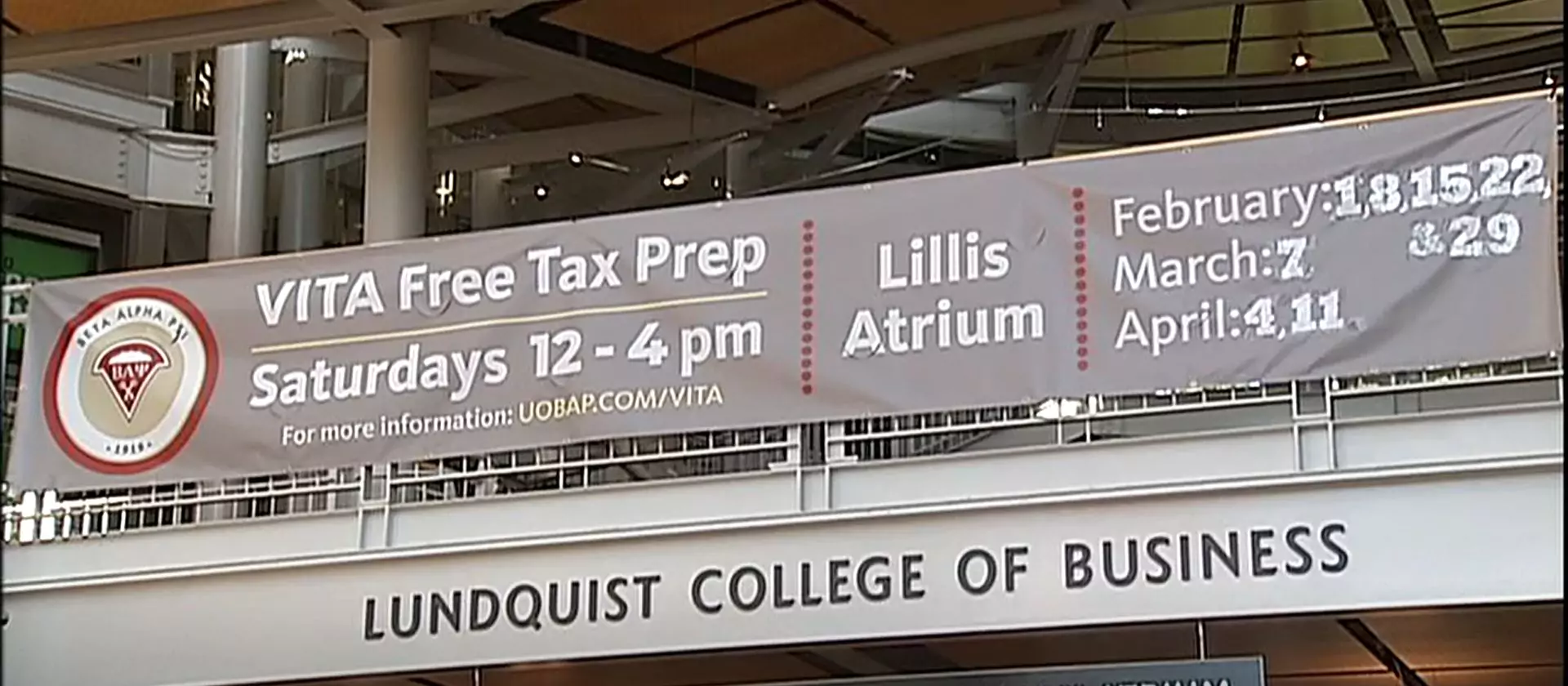

Two things that are making tax filing easy and free for Oregonians

In this episode of Policy for the People, we discuss two initiatives that are making tax filing easy and free.

February 13, 2025