[This issue brief was updated on April 4, 2022.] Oregon families are among the least likely to benefit from the

Family Tax Credits

Family Tax Credits

Latest Articles

In the latest episode of Policy for the People, we discuss the Build Back Better legislation before Congress with Samantha

This tax credit is targeted to low- and middle-income Oregonians. About 90 percent of the tax credit goes to families

A tax credit intended to lift up working families leaves out more than a quarter-million Oregonians, most of them U.S.

More than a quarter-million Oregonians in working households — most of them U.S. citizens and authorized immigrants — cannot claim

Oregon denies certain tax filers from benefiting from our state’s Earned Income Tax Credit based on their immigration status. My

Even good public policy can be made better. That’s the case with Oregon’s Earned Income Tax Credit (EITC), one of

All workers, no matter our place of origin, should be able to earn enough to care for our families. Laws

Love is in the air — the fresh pine air of Oregon. This Valentine’s Day also happens to be Oregon’s

Latest Podcasts

Senator Wyden on the Trump tax plan: “It’s going to cause a lot of hardship”

The Trump tax plan would cut Medicaid and nutrition assistance to pay for big tax cuts for the rich.

April 10, 2025

How to improve pay and working conditions in entire industries in one fell swoop

The revival of an old idea is offering hope for improving pay and working conditions in entire industries all at

March 13, 2025

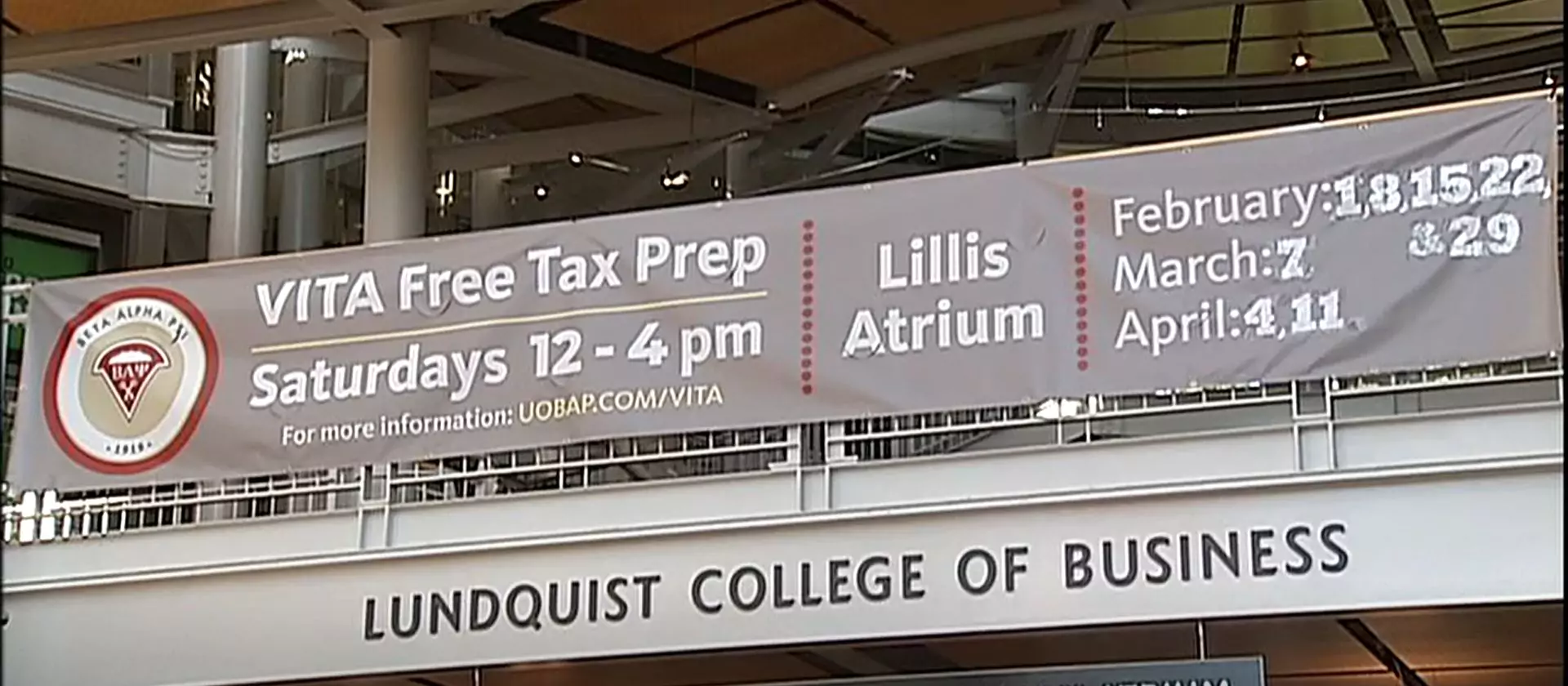

Two things that are making tax filing easy and free for Oregonians

In this episode of Policy for the People, we discuss two initiatives that are making tax filing easy and free.

February 13, 2025

The most important legislation in a generation