Senator Wyden on the Trump tax plan: “It’s going to cause a lot of hardship”

The Trump tax plan would cut Medicaid and nutrition assistance to pay for big tax cuts for the rich.

The Trump tax plan would cut Medicaid and nutrition assistance to pay for big tax cuts for the rich.

The revival of an old idea is offering hope for improving pay and working conditions in entire industries all at once. That policy is often referred to as Workforce Standards

Oregon can crack down on tax avoidance by large, multinational corporations by enacting a policy known as worldwide combined reporting, a change that would yield more than $100 million a

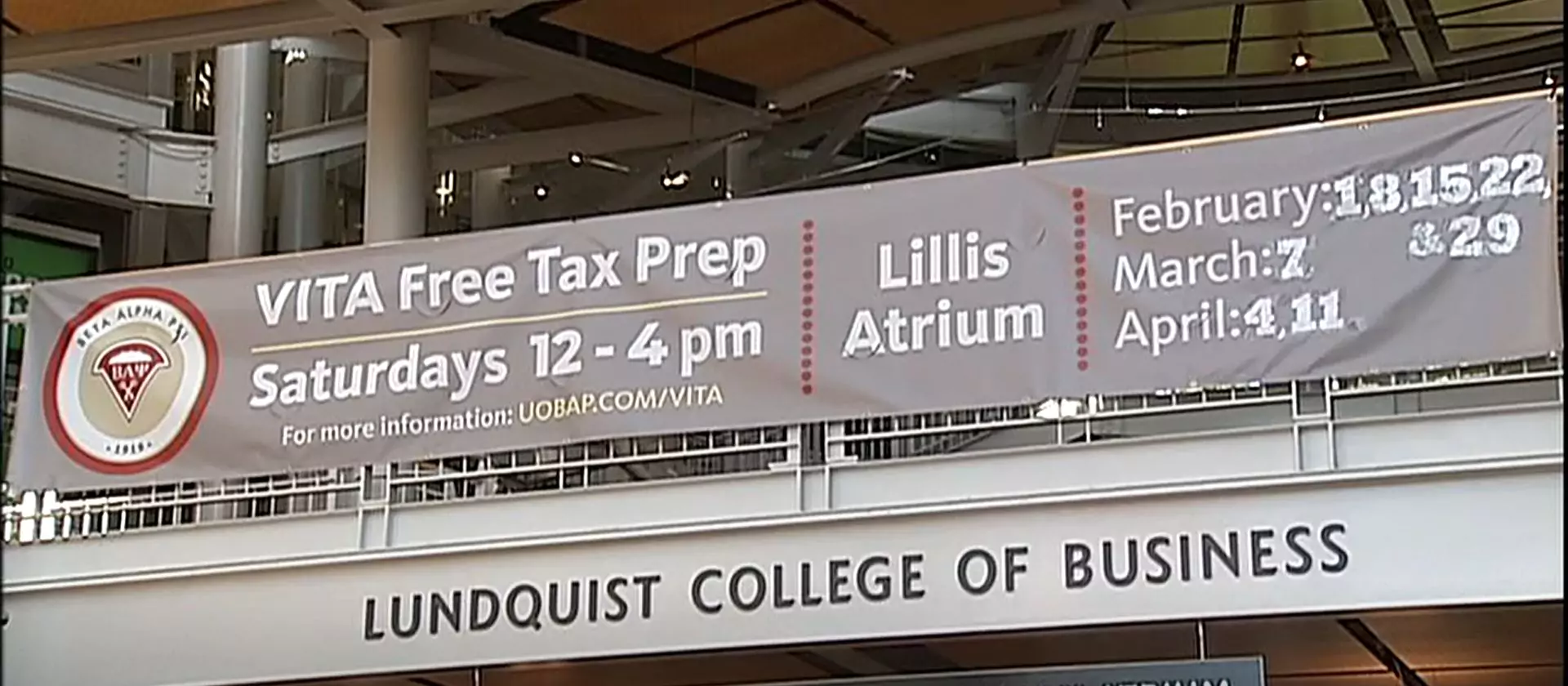

In this episode of Policy for the People, we discuss two initiatives that are making tax filing easy and free. The first is Direct File. This online tool created by

This year, eligible Oregonians can file their taxes for free using IRS Direct File. This online tool is linked to Oregon’s own Direct File system, creating a seamless way to

A dozen Oregon organizations sent a letter to the state’s congressional delegation today calling on them to oppose tax cuts for the wealthiest individuals and corporations as part of the

Experiments in Oregon and across the country show that guaranteed income, unconditional cash, is very effective at improving economic and mental well-being.

Labor Commissioner Christina Stephenson explains the surge in claims and staffing shortage confronting the Oregon Bureau of Labor and Industries.

This episode of Policy for the People takes a deep dive into Measure 118, the Oregon Rebate.

Bob Lord of Patriotic Millionaires explains why we need to tax extreme wealth in order to shrink inequality and save our democracy.

© Oregon Center for Public Policy 2023