OCPP’s top 5 stories for 2019

As 2019 draws to a close, we look back at the Center’s publications that proved most popular. Here they are, starting with the fifth most popular:

As 2019 draws to a close, we look back at the Center’s publications that proved most popular. Here they are, starting with the fifth most popular:

Following the failed playbook of trickle-down economics, the tax package lavished massive tax cuts on the rich and corporations.

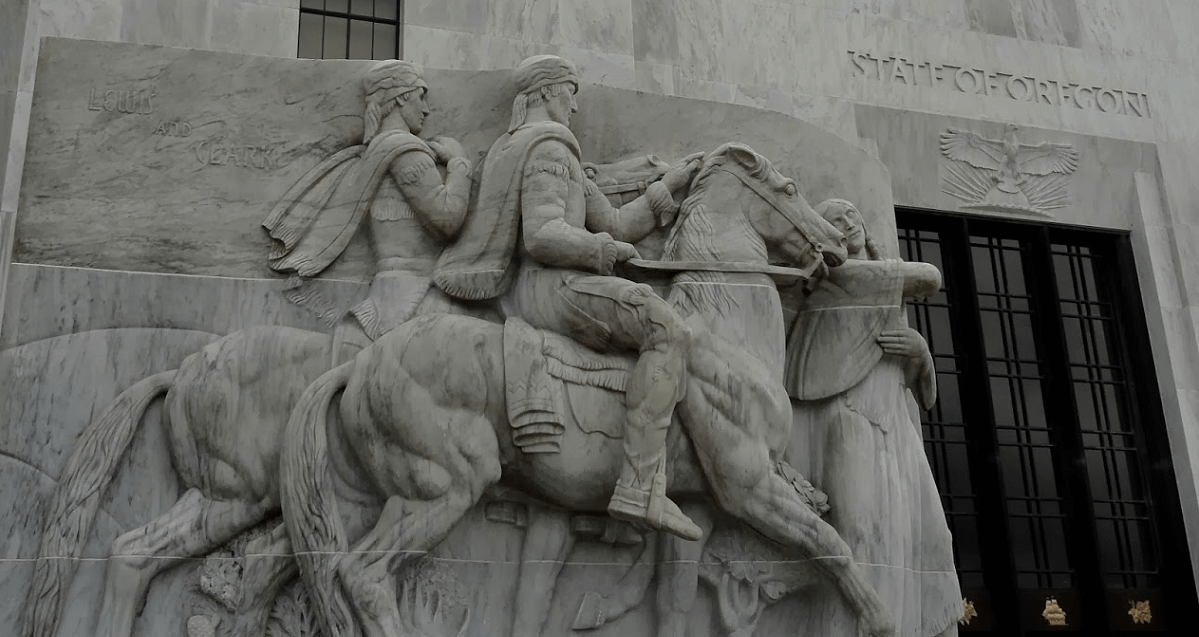

If two people earn the same amount, they should pay the same tax rate. That’s a bedrock principle of tax fairness. Oregon had long lived by this rule, until one shameful day six years ago today.

State lawmakers have much to be proud of, having enacted Oregon’s largest investment in education in memory. This and future generations of Oregonians will be better off for it.

This May Day arrives as many workers in Oregon struggle just to get paid for their labor.

One night a year, authorities and volunteers nationwide count the homeless. The most recent count revealed less than half of Oregon’s homeless families with children found shelter that night.

Oregon’s corporate minimum tax needs a significant boost for it to meet its intended purpose — ensuring that all corporations make a meaningful contribution to the common good.

As 2018 draws to a close, we look back at the Center’s publications that proved most popular.

Oregon teachers deserve a raise. Teachers play an essential role in helping children achieve their potential and contribute to our communities. Unfortunately, Oregon significantly underpays its teachers relative to comparable workers in the private sector.

In 1862, not long after joining the Union, Oregon enacted a tax on people of color. If you were black, mixed-race, Hawaiian, or Chinese, you had to pay a tax not levied on white Oregonians.

© Oregon Center for Public Policy 2023