Legislature fails to spare children facing hardship

The recently-concluded special session of the Oregon legislature was not so special for families suffering extreme hardship.

The recently-concluded special session of the Oregon legislature was not so special for families suffering extreme hardship.

Federal help for workers enacted in response to the coronavirus (COVID-19) crisis leaves out a key portion of Oregon’s workforce. Already excluded from most safety net supports, undocumented workers laid off from their jobs find themselves in an especially vulnerable situation.

For some families economically hit by the coronavirus pandemic, Oregon’s Temporary Assistance for Needy Families (TANF) program is the last line of defense.

With some changes, Oregon’s Unemployment Insurance (UI) program can help Oregonians better cope with the COVID-19 (coronavirus) pandemic. The virus and efforts to contain it threaten to disrupt the workplace. Quarantines, layoffs, and other upheavals put at risk the economic well-being of working families, especially those living paycheck-to-paycheck. By making appropriate changes to its UI program, Oregon can help workers and businesses weather this health emergency.

Oregon families are among the least likely to benefit from the Earned Income Tax Credit (EITC) — a tax credit designed for families surviving on low wages.

Progress has stalled. That’s the main takeaway from the latest data on health insurance coverage in Oregon, released yesterday by the U.S. Census.

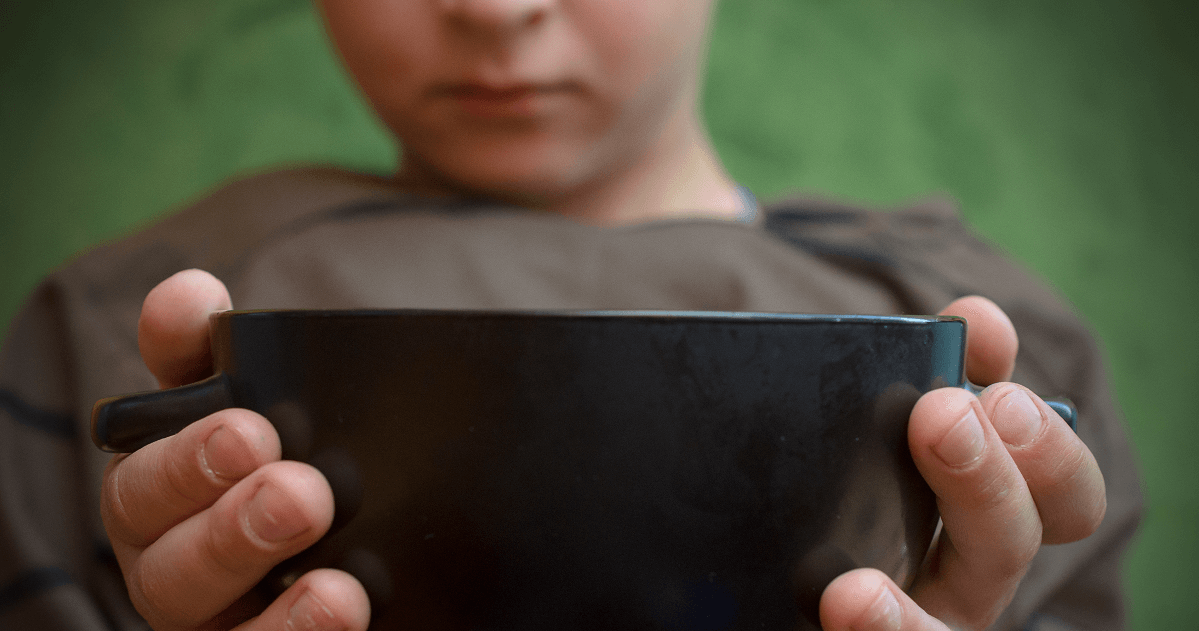

In the richest country in the world, the fact that many families don’t have enough to eat ought to be treated as a national emergency. It ought to be a priority of the highest order to make sure that no one is food insecure.

Without a doubt, our country can vastly improve the economic prospects of families scraping by on low wages.

While it’s unclear whether the Trump administration will involve the nation in a new armed conflict in the Middle East, this much is certain: it has no qualms about waging war against this country’s poor families.

Tax Day is one of the most important days on the calendar when it comes to the fight against poverty. Today, many working families in Oregon struggling to pay the bills will claim on their tax returns the Earned Income Tax Credit (EITC), one of the most effective anti-poverty tools available.

© Oregon Center for Public Policy 2023